If you’ve been paying attention to the housing market, you

know that it has been a very interesting year. Home values are on the rise,

with lots of people wanting to buy and not enough houses to go around. Interest

rates have also gone up. With all this going on, many people are wondering: Is

it still a good time to buy a house? Maybe I should wait.

It’s a valid question! There’s no doubt, there have

definitely been easier times to be a home buyer. However, if you are otherwise

in a position to buy, it’s important to take a step back and look at the big

picture. Though prices and interest rates have gone up, which increase

costs for buyers, it’s possible that the costs of waiting could be even higher.

Let’s break it all down.

Home Prices

Though home prices are on the rise, waiting for them to go

down is not necessarily the prudent choice it may appear to be at first glance.

First, prices are unlikely to go down; just the opposite in fact – they are

predicted to continue rising for some time to come (though at a slower rate

than they are now). So if you are waiting for the bubble to burst… it just

might not happen.

Appreciation

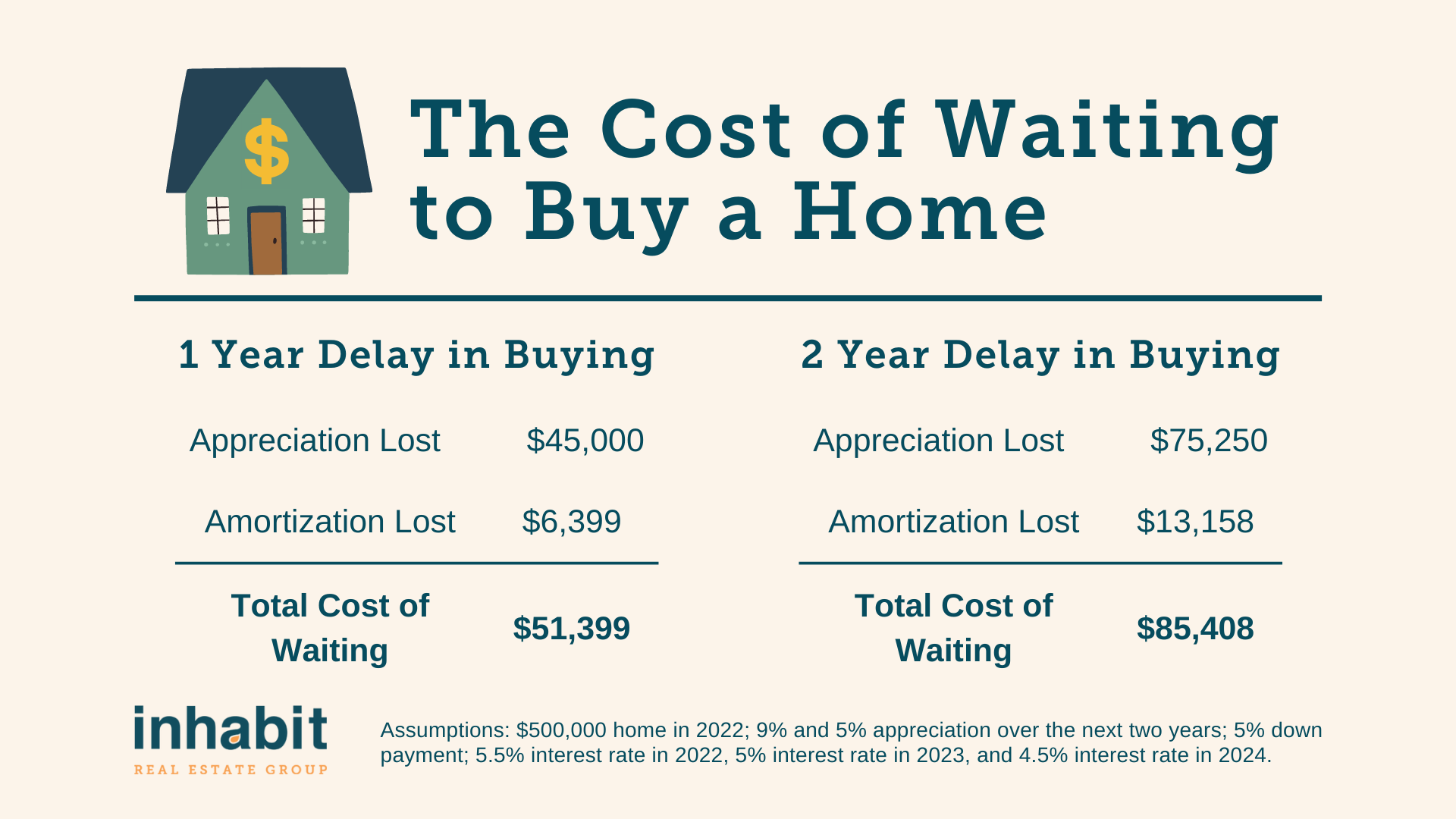

Second, waiting to buy not only means you’re missing out on

the comparatively lower prices available now, you are also missing out on the

appreciation of your purchase.

Let’s say you are interested in buying a $500,000 home now,

but decide to wait. That same home is likely to cost $545,000 next year, and

$572,250 the year after that. (This is assuming an appreciation rate of 9% over

the next year, and of 5% the year after that. This is the average of predictions

made by CoreLogic, The Mortgage Bankers Association, Fannie Mae, and Zillow.[1])

So not only will house prices be more expensive when you decide to look again

in a year or two, but if you had purchased when you originally thought of it,

your purchase would have increased in value significantly – value that you

unfortunately have now missed out on.

Lost Amortization

The lost year or two is also time that you are missing out

on amortization (payoff of your original loan amount, or equity gained).

Let’s say you decided to purchase that $500,000 house now

after all. You paid a $25,000 down payment (5%), and have a 30 year mortgage at

a 5.5% interest rate. In one year you would have shaved off over $6,000 of your

original loan balance. In two, it would be up to $13,000.

Whereas in two years if you hadn’t purchased the home yet,

you’d be at 0% equity, AND have a more expensive price point on that home. Combining

the appreciation and the amortization you missed out on, waiting two years

could cost you roughly $85,000 in this scenario.

Real Estate as Investment

We’ve been talking primarily about the purchase of a home so

far, but all of the above also apply to folks wanting to invest in real estate.

In addition to the above points, real estate is also generally considered a fairly

safe investment, since home values almost always rise over time. If you have

been seeing your stocks take a dip lately, why not consider investing in real

estate for awhile? Some folks even use their self-directed IRA for this

purpose.

Conclusion

Of course, it’s very important to note that all of this

depends on your particular situation. What applies generally may not apply for

you at this exact moment in your life. It is important to determine what is

appropriate for you based on your finances, future plans, and preferences. A conversation

with a trusted real estate or mortgage professional can be a very valuable part

of helping you get the information you need to make these decisions.

Thinking of buying or selling soon? Talk to one of our

experienced agents

today. Special thanks to Jordan Monroe at Legacy Mutual Mortgage

for his expertise and spreadsheets, which were a tremendous help with this post!

[1] Lambert,

Lance. “What home prices will look like in 2023, according to Zillow’s revised

downward forecast.” Pars. 4, 9. April 21, 2022, 3:57 PM CDT) Fortune.com, fortune.com/2022/04/21/zillow-cuts-its-housing-market-and-home-price-forecast-for-2022-and-2023